pay indiana state property taxes online

On this site youll find the following personal property forms. 166 out of 736 found this helpful Have more questions.

State Taxes For Us Expats What You Need To Know Bright Tax

Payments may be made using Visa MasterCard or Discover creditdebit cards.

. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Pay your full property tax bill via a participating bank. You may also register with or login to our website to view update and add parcels to your profile.

How Do I Look Up Property Taxes In Indiana. Please contact the Indiana Department of Revenue at 317 232-1497. Please contact the Marshall County Treasurer at 574-935-8520.

Ways to pay your taxes. Pay Property Tax Online Property Tax Information Emergency Alerts and Public Notices System Problem Solving Courts File Homestead and Mortgage Deductions Online Update Tax Billing Mailing Address Tax Sale Information General Contact Info Howard County Admin. Try our new website at.

Community Corrections La Porte County Animal Shelter Donations Probation Fees. The transaction fee is 25 of the total balance due. Pay Taxes Electronically Customers can quickly and securely pay their taxes electronically.

Select Tax Year 2020 2021 Select Filing Information Single Married Filing Jointly Married Filing Separately Back. Form 102 - Farmers Tangible Personal Property Assessment Return State Form 50006. This search may take over three 3 minutes.

Payment Plan Set up a payment plan online INBIZ Indianas one-stop resource for registering and managing your business and ensuring it complies with. Visit any tri-state Old National Bank with your. Mail is often.

For additional information please contact the Floyd County Treasurers Office. How Do I Pay My Indiana Property Taxes. Online Tax Resources Paperless Billing Paying Your Taxes Property Tax Form Helpful Links Directions Barbara J Hackman Treasurer The Treasurer is an elected position authorized by Article 6 Section 2 of the Indiana Constitution and serves a four 4 year term.

If you have an account or would like to create one or if you would like to pay with Google Pay PayPal or PayPalCredit Click Here. Welcome to INtax The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247. To make an online payment for a traffic ticket you received please click on the link below.

Online Card eCheck Online Property Tax Payment. The state Treasurer does not manage property tax. Pay Your Property Taxes This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card.

If you want your property tax to be mailed to you send it to You can do this by paying with the bank that participates in the program. Home Online Payments La Porte County government accepts credit or debit card payments through Central Payment Corporation a third party agency. Gain access to your online tax payment receipts.

Please put the address of your tax payment in the box provided. Payments may be made on line 24 hours a day. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65.

Was this article helpful. Center 220 N Main St Kokomo IN 46901 Open Monday-Friday from 8am-4pm. 4TAX 4829 or 1888 You can pay your property tax by mail.

Transaction Fees are Non-Refundable. To view and pay your 2021 pay 2022 Property Tax Bill. It collects various taxes including local and state property taxes inheritance taxes and delinquent taxes.

Pay by phone toll free. Please contact your county Treasurers office. Go to httpwwwingovmylocal and choose your county to view a list of county Web sites.

Make sure you are paying for local payments Enter our location information Indiana Vanderburgh County. You will need the Monroe County Jurisdiction Code. To view and pay your Property Taxes online please click on the link below.

Please enter 4TAX 4829 or 1888 into the box below. Make an Online Payment. Search for your property Search by address Search by parcel number.

Welcome to the State of Indiana Personal Property Online Portal PPOP-IN a convenient online portal through which taxpayers can file their personal property returns. Phone Card eCheck 1-877-690-3729. You can pay your property tax over the phone by calling 317327.

To make a payment toward a payment plan or an existing liability or case click here. INTAX only remains available to file and pay special tax obligations until July 8 2022. Contact the Property Tax Office by phone to request a payment schedule.

The primary duty of the Treasurer is that of tax collector. City of Indianapolis Marion County Payment Portal Search Options Your total payment including the credit card online transaction fee will be calculated and displayed prior to the completion of your transaction. All taxes not paid by the deadline will be assessed a penalty per Indiana Code 6-11-37-10.

INtax only remains available to file and pay the following tax obligations until July 8 2022. To pay the balance in full select the tax year below. The Treasurers Office collects retains custody of and disburses county funds.

Mailed payments are considered on time when postmarked by the USPS by the due date. Create an INtax Account. Property taxes are not managed by the state treasurer.

Is Indiana Tax Friendly Where Hoosier State Ranks Nationally

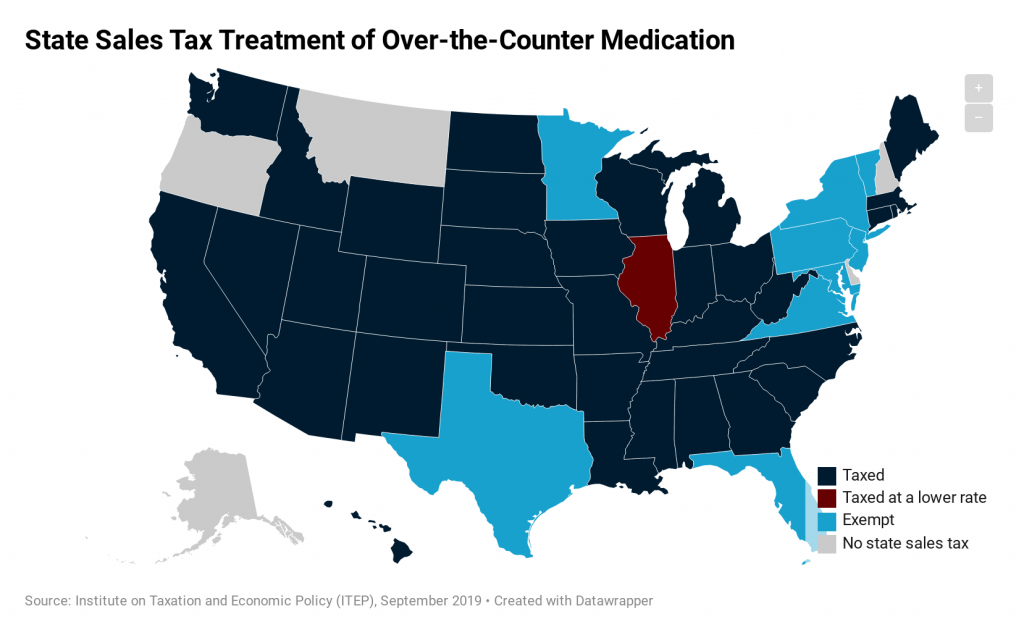

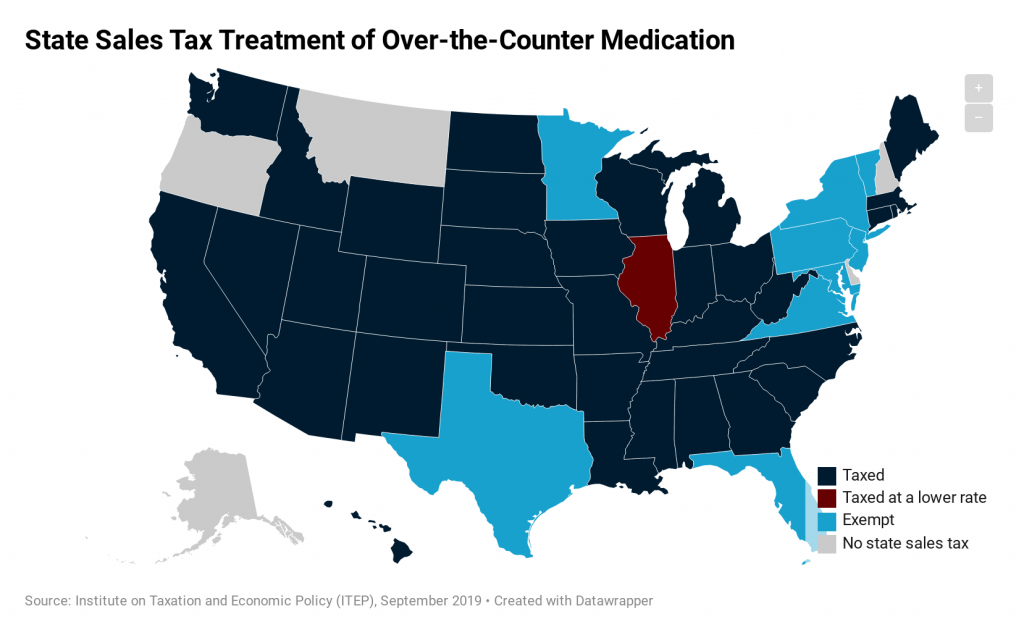

How Do State Tax Sales Of Over The Counter Medication Itep

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

Corporate Tax Rates By State Where To Start A Business

Property Taxes By State County Lowest Property Taxes In The Us Mapped

How Do State And Local Sales Taxes Work Tax Policy Center

States With The Highest And Lowest And No Sales Tax Rates States With Lowest Local Sales Tax Youtube

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

State Income Tax Rates Highest Lowest 2021 Changes

Do I Have To File State Taxes H R Block

A Visual History Of Sales Tax Collection At Amazon Com Itep

How Do State And Local Individual Income Taxes Work Tax Policy Center

States Without Sales Tax Article

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Where S My State Refund Track Your Refund In Every State Taxact Blog

Blog Us Tax Lien Association Types Of Taxes Us Tax Exit Strategy

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)